Social economy: Resilience and growth

The number of social enterprise organisations in Northern Ireland has almost doubled in the last five years, the amount of employees has more than doubled and the average combined turnover has risen by £300 million, presenting a resilient and growing sector with the potential to a re-balancing of Northern Ireland’s economy.

The return of the Executive and enhanced finances from Westminster brought with it a broader conversation around Northern Ireland’s dependence on Treasury funding and the absence of self-sufficiency in regards to revenue raising. A key tenet of the New Decade, New Approach deal is the implication that Northern Ireland must seek to change how it manages and delivers on its budgetary responsibilities.

A number of significant measures within the deal, most noticeably greater scrutiny from Westminster, indicate a clear desire to re-balance how Northern Ireland’s economy is currently operated. ‘Re-balancing the Northern Ireland Economy’, a report on social enterprise commissioned by Social Enterprise Northern Ireland (SENI), points directly to the enhanced role the social enterprise sector in Northern Ireland is playing and can play in such a transition.

The direct economic benefit of the social enterprise sector is estimated to be some £294 million Gross Value Added (GVA). An estimated 14,450 jobs exist in the social enterprise sector and some £385 million worth of wages are generated. The sector has undoubtedly grown and diversified since 2013, the last time a comprehensive study was carried out.

Resilience, it is argued, is increasing as evidenced by the fact that the most common source of income for social enterprises is trading activity. Around one third of organisations have other social enterprises as part of their supply chain and the number of social enterprises is growing.

The sector has seen an upturn in start-ups. 40 per cent of organisations surveyed for the report were trading for less than five years and one quarter for less than two years. However, it is also exhibiting the commercial potential of social enterprise organisations. Three quarters of these organisations made a profit in the last financial year and over 60 per cent recorded an increase in turnover when compared with the previous 12 months.

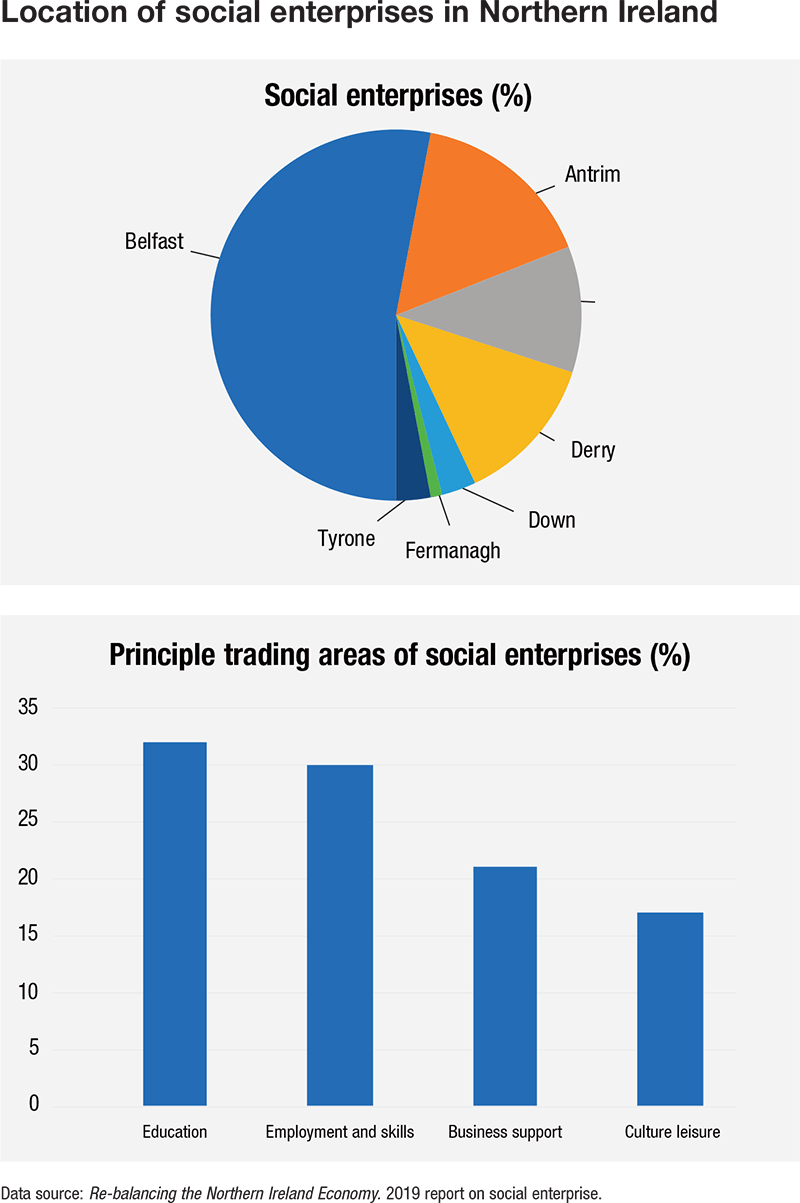

Historically, social enterprise activity has concentrated in the services of education, employment and skills, and business support and consultancy. However, the report indicates a noticeable increase in the number of social enterprises operating in health care, social care and at greater levels in education. Additionally, activity in retail activity is “significant” indicating a similar trend across the UK of diversification of income away from the public sector.

The majority of social enterprises in Northern Ireland continue to be micro in size (between one to 10 employees), however, the number of organisations (24 per cent) reporting a turnover of £1 million or more has increased significantly since 2013 (13 per cent). Almost 70 per cent of social enterprises are operating on a microscale, 15 per cent on a small scale, 12 per cent on a medium scale and 56 per cent are large social enterprises, with 250 employees or more.

Anecdotal evidence suggests that the prevalence of volunteering in the sector has fallen since 2013 levels but the report reasons that this is due to a “more business-focussed model”.

Community impact

The report stresses that the social economy’s beneficial reach is wider than economic improvement. Referring to the draft Programme for Government’s indicators it highlights delivery in terms of tackling disadvantage and deprivation. Of the social enterprises surveyed for the report, 25 per cent were operating and trading from the top 50 most deprives Super Output Areas in Northern Ireland.

However, while mirroring 2013, the percentage of those respondents identifying the ‘local community’ as the single biggest beneficiary of social enterprise activity. has fallen from 78 per cent to 65 per cent.

More than half of social enterprises reported over 50 per cent of their workforce as living in the immediate local area and when asked about recruitment, almost 60 per cent outlined an ambition to increase their number of employees.

The majority (53 per cent) of social enterprises are concentrated in Belfast. The number of Belfast-based social enterprises has risen from 35 per cent in 2013 to 53 per cent in 2018. Urban centres, the north-east and the north-west are also areas of greater concentration for social enterprises, while the number of organisations are significantly lower in the east and west.

The potential for social enterprise to aid the rebalancing of Northern Ireland’s economy is reliant on the long-lobbied for Social Value Act becoming reality under the new Executive. Such an Act, already in place in other parts of the UK, would put a statutory duty on the public sector to demonstrate and maximise the social impact of its spending priorities.

However, barriers to progress have been identified. Brexit, finance and reduced funding have all been identified as the top three obstacles to sustainability and growth.