No deal: trade and investment

Evidence gathered by the Northern Ireland Civil Service has outlined “a profound and long-lasting” impact on the Northern Ireland economy and society of a no deal outcome including the loss of some 40,000 jobs, a 9.1 per cent fall in GVA, a £180 million decline in exports and a 6 per cent fall in FDI attractiveness.

The evidence by the Department for the Economy, first published in July following requests for the statistics held by the Northern Ireland Civil Service (NICS) on the implications of a no deal outcome and broader statistics on cross-border trade, makes for bleak reading for the future of Northern Ireland’s economy if a deal cannot be reached between the UK and the EU.

The evidence sets out the broad range of direct and indirect impacts of a no deal outcome, acknowledging the interconnectedness of the trade and transport conditions framework. It acknowledges that with many changes happening all at once, setting a limit on the impact of no deal is an impossible task.

Summarising the risks and impacts, the Department estimates that unemployment levels would rise sharply given the economy’s EU export exposure. Key industries identified as most at risk employee some 525,000 people, not including farming employment, and around 40,000 of these jobs are heavily reliant on free access to the EU market. Those reliant on EU access do not include figures from the financial services or tourism sectors, which would likely see the potential job loss figures increase.

On key industries, the Department states bluntly: “The stark reality is that many of these jobs could disappear overnight, especially in industries such as agri-food and haulage.”

Competitiveness

EU tariffs are expected to reduce trade between north and south by some 11 per cent. However, the inclusion of non-tariff barriers means that this figure is likely to rise to 19 per cent. In terms of who this would affect, around 51 per cent of goods firms in Northern Ireland and 46 per cent of services firms are deemed “at risk” in relation to their ability to absorb shock.

A focus on services highlights a 14.5 per cent average increase in the cost of exporting to Ireland, translating as a loss of around £120 million annually and an increase in the cost of doing business. These increases would be exacerbated by further losses of around £50 million in exports to the rest of the EU.

As Northern Ireland’s biggest external trading partner, a no deal outcome’s impact could see GVA for Northern Ireland fall by 9 per cent compared to if the UK remained in the EU. This is because Northern Ireland’s exports to the UK face a twofold risk. Firstly, because of GB’s stated intention to export to the rest of the world and therefore open itself up to additional imports and increase the competition for Northern Ireland sellers. Secondly, any downturn felt by GB exporters because of WTO tariffs will have a knock-on effect to the supply chain, of which Northern Ireland plays a key part.

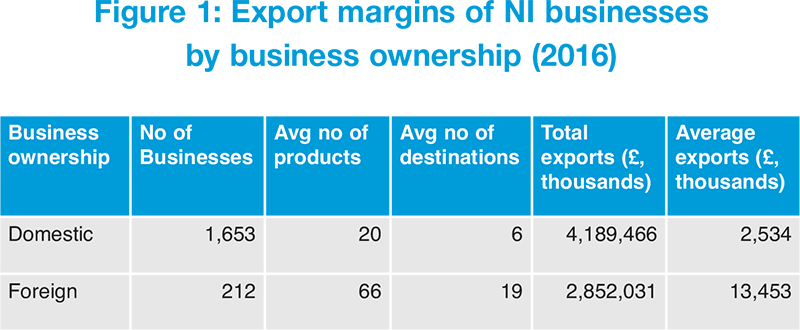

As well as a recognisable decline in consumer purchasing power likely to be caused by any border frictions, the Department’s report outlines a potential 6 per cent annual loss in FDI in the medium to long term and a 7.6 per cent loss for FDI-related jobs. This is because while only 1.5 per cent of businesses in Northern Ireland are non-UK owned, these businesses employ over 13 per cent of the workforce (see Figure 1.)