Contrasting forecasts but similar risks

The European Commission (EC) has published its Summer 2018 Interim Economic Forecast, predicting growth set to remain strong in 2018 and 2019, despite increased uncertainty.

The data, which includes gross domestic product (GDP) growth and inflation for all 28 EU member states, estimates growth of 2.1 per cent for 2018 and 2 per cent for 2019.

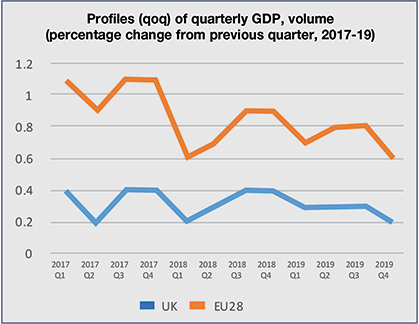

The EC’s spring prediction has been revised down slightly after five consecutive quarters of “vigorous expansion” moderated in the first half of 2018. However, the EC expects growth momentum to strengthen in the second half of 2018 driven by improved labour conditions, household debt decline and a continuation of consumer confidence and supportive monetary policy.

On the moderation of growth, it points to temporary factors, stating: “The fundamental conditions for sustained economic growth in the EU and the euro area remain in place. The moderation in growth rates is partly the result of temporary factors, but rising trade tensions, higher oil prices and political uncertainty in some Member States may also have played a role.”

Adding: “Globally, growth remains solid but rates are becoming more differentiated across countries and regions.”

Looking at inflation, it states that a rise in oil prices is behind the upward revision to 1.9 per cent average across the EU since the Spring forecast. Inflation is expected to rise again by 0.1 per cent in 2019 for the euro area, but remain the same for the whole of the EU.

Although economic performance across the EU has been resilient to date, the EC acknowledges that forecasts “remains susceptible to significant downside risks,” acknowledging that these risks have increased since spring.

It states: “The forecast baseline assumes no further escalation of trade tensions. Should tensions rise, however, they would negatively affect trade and investment and reduce welfare in all countries involved. Other risks include the potential for financial market volatility linked to, inter alia, geopolitical risks.”

The forecast looks at each individual member state, below is a summary of the UK and Ireland outlook:

The UK

A significant slowing at the beginning of 2018 was attributed in part to severe weather disruption in March. The euro area and EU outlook forecast suggests that 0.2 per cent drop in GDP growth won’t be recovered in the near future as both the construction and manufacturing sectors are facing capacity constraints.

Overall for 2018 “private consumption growth is expected to remain subdued despite support from generally easing inflation, reflecting low consumer confidence and an anticipated stabilisation in the household saving rate”.

The forecast projects investment growth to remain weak as uncertainty about the future UK-EU relationship remains. Net trade is expected to moderate in 2018, in line with the unwinding of the boost from sterling’s 2016 depreciation and moderating export growth. As a result, a modest GDP growth of 1.3 per cent in 2018.

Internally, an unexpected rise in household saving rates could lead to a reduction in consumption growth. Externally, the UK as an open economy is vulnerable to global escalation of trade protectionist measures, which could inhibit export growth.

The forecast is done on the assumption of the current status quo of trading relations and under this, GDP growth is projected to remain weak at 1.2 per cent in 2019.

Ireland

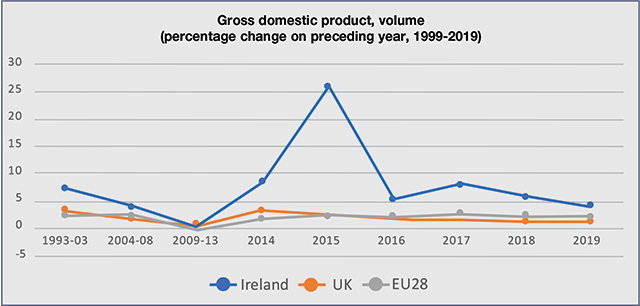

Ireland’s labour market and construction investment have maintained strong momentum in the first half of 2018, with employment recovering to pre-crisis levels in the first quarter and unemployment continuing to fall. Rising wages, low inflation and growth in full-time employment is driving consumer confidence as household real disposable income increases. Construction output measured as being up 20.6 per cent over the year in Q1 of 2018.

The forecast states: “Headline trade and investment figures have recently been very volatile and heavily influenced by the activities of multinational companies. While the outlook for the euro area slightly worsened, the overall external economic environment is expected to remain broadly supportive of Irish exports over the forecast horizon.”

Domestically, economic activity is expected to continue to grow and investment in construction is forecast to continue to expand driven by demand from the housing crisis. Real GDP estimates are for growth of 5.6 per cent in 2018 and 4 per cent in 2019.

Consumer prices were “subdued” in early 2018, mainly due to lower import prices because of the euros appreciation against sterling. However, projections are for a 1 per cent rise this year and a 1.3 per cent rise in 2019, driven by higher energy and services prices while upward pressure is placed on wages by a further tightening in the labour market.

Risks identified are similar to those of the UK. As well as Brexit uncertainty, Ireland is exposed to changes in the international taxation and trade environment. The forecast adds: “Activities of multinational companies could swing headline GDP growth in either direction.”