Public finance: the way ahead

Northern Ireland needs to consider raising more revenue locally and must spend capital allocations to avoid building up debt,

Northern Ireland needs to consider raising more revenue locally and must spend capital allocations to avoid building up debt,

Victor Hewitt writes. The rising cost of breaking with parity could also lead to political tensions.

Spending Review 2013 (SR2013) announced in June set departmental expenditure limits for both revenue/current and capital expenditure (RDEL and CDEL respectively) by English departments for the 2015-2016 financial year. This completed the work on fiscal retrenchment and deficit reduction the Coalition started with the Emergency Budget in 2010 and subsequently the 2010 Spending Review which covered the years up to 2014-2015.

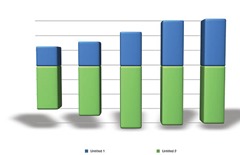

Spending reviews are important to Scotland, Wales and Northern Ireland because they carry over through the operation of the Barnett formula to impact on devolved budgets. Starting from an opening baseline which had already been reduced in the Emergency Budget, SR 2010 and SR2013 made the adjustments in the Northern Ireland Executive budget shown in the chart below.

Northern Ireland cash changes from 2010-2011 baseline: revenue (blue) and capital (green)

Broadly speaking, what this chart says is that the resources provided by the Treasury for current expenditure continue to rise but by less than expected inflation so that, in real terms, the Executive is given a slightly smaller sum year by year. Treasury calculates a 0.1 per cent fall in cash RDEL in 2015-2016 whereas the Department of Finance and Personnel calculates a 0.6 per cent increase. The discrepancy is due to the use of different baselines for the calculation.

On the capital side, the picture is much worse since the capital allocation to the Executive actually falls quite sharply in cash and much more quickly when inflation is taken into account. The most severe cut in capital is in 2013-2014, the current budget year, and SR2013 has actually eased the position on capital but the overall position still remains a cut.

In public expenditure, however, things are never quite as they seem. In terms of resources, these figures do not take account of the additional spending available to the Executive through its own efforts, and in particular the regional rate. Receipts from the regional rate, which is levied by the Executive, are running at around £600 million per year and rising. Hence one way of helping to off-set Treasury cuts is by greater self-help through higher rates and other charges (including domestic water charges).

While the budget for law and order has now been transferred to the Executive, it is effectively ring-fenced and subject to special treatment. In 2011, the Treasury agreed to provide the PSNI with an additional £200 million to counter rising terrorist threats and in the SR2013 a further £31 million was made available in 2015-2016 to maintain this stance.

The Department of Justice (DoJ) budget is also outside the budget exchange scheme that limits how much under-spend on the Northern Ireland public expenditure block can be carried forward each year. The DoJ has effectively unlimited carry forward of its under-spends until 2014-2015 (though with the condition that these are the first call for urgent security spending).

Capital projections

On the capital side, SR2013 provided an easement of 3.3 per cent in capital cuts in 2015-2016 (1.5 per cent in real terms). However, £104.3 million of this additional capital is classified to financial transactions to support private sector equity or loans and this form of capital is strictly ring-fenced by the Treasury. On the other hand, borrowing of £200 million per year continues through the period to 2015-2016 and supports conventional capital spend beyond the capital allocation from the Treasury.

In 2014-2015 and 2015-2016, this facility will be extended by £50 million in each year to fund agreed projects as set out in the ‘Building a Prosperous and United Community’ document published on

14 June. Borrowing is a very useful advantage but it is not free and interest on past borrowing is now running at around £50-60 million each year. To keep this bill down, it is imperative that conventional capital allocations are, as far as possible, fully spent before more debt is incurred.

Current and capital spending is the main focus of attention in Northern Ireland but there is another form of spending called annually managed expenditure (AME) which is almost as large as the Executive’s budget. This is administered, rather than controlled, by the Executive and is directly funded by the Treasury outside the Barnett formula. Most of the spending in AME is on pensions and benefits. Pensioners are protected from expenditure cuts but the entire benefits system in England has been transformed with major savings being pursued by the Treasury.

Parity consequences

Benefits legislation in Northern Ireland parallels that in England but it is separate legislation that is under the control of the Assembly and the parity principle is not absolute. However, the other side of that coin is that if the Executive breaks parity in benefits its budget must meet the costs. That scenario is now starting to become a reality because the Assembly has so far refused to bring Northern Ireland into line with the welfare reforms in Great Britain, and this is threatening a financial crisis.

The Treasury has warned that it is losing £5 million of savings per month because the welfare systems are not aligned and if this is not done by January 2014, the full cost will be taken from the Executive’s budget. Potentially the bill could rise to £200 million per year by 2017-2018 and much larger amounts thereafter. There are obvious political dangers in this position for the solidarity of the Executive.