Local government planning statistics

The latest planning statistics (Q3 2017/18) published by the Department for Infrastructure provide a summary of local government performance in local development applications, major development applications and enforcement cases.

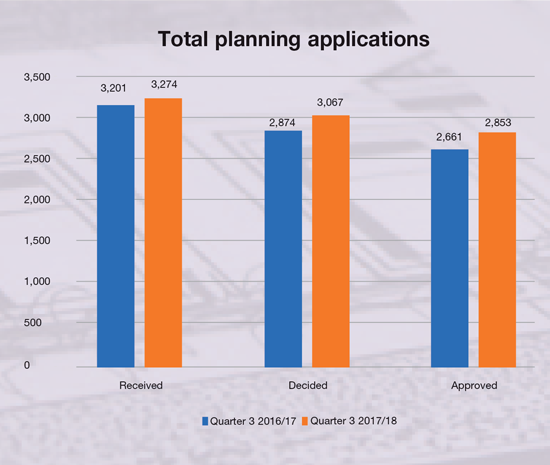

A total of 3,274 planning applications (3,232 local, 41 major and one of regional significance) were received in Q3 2017/18, representing a 2 per cent increase both on the previous quarter and on the same period in 2016/17.

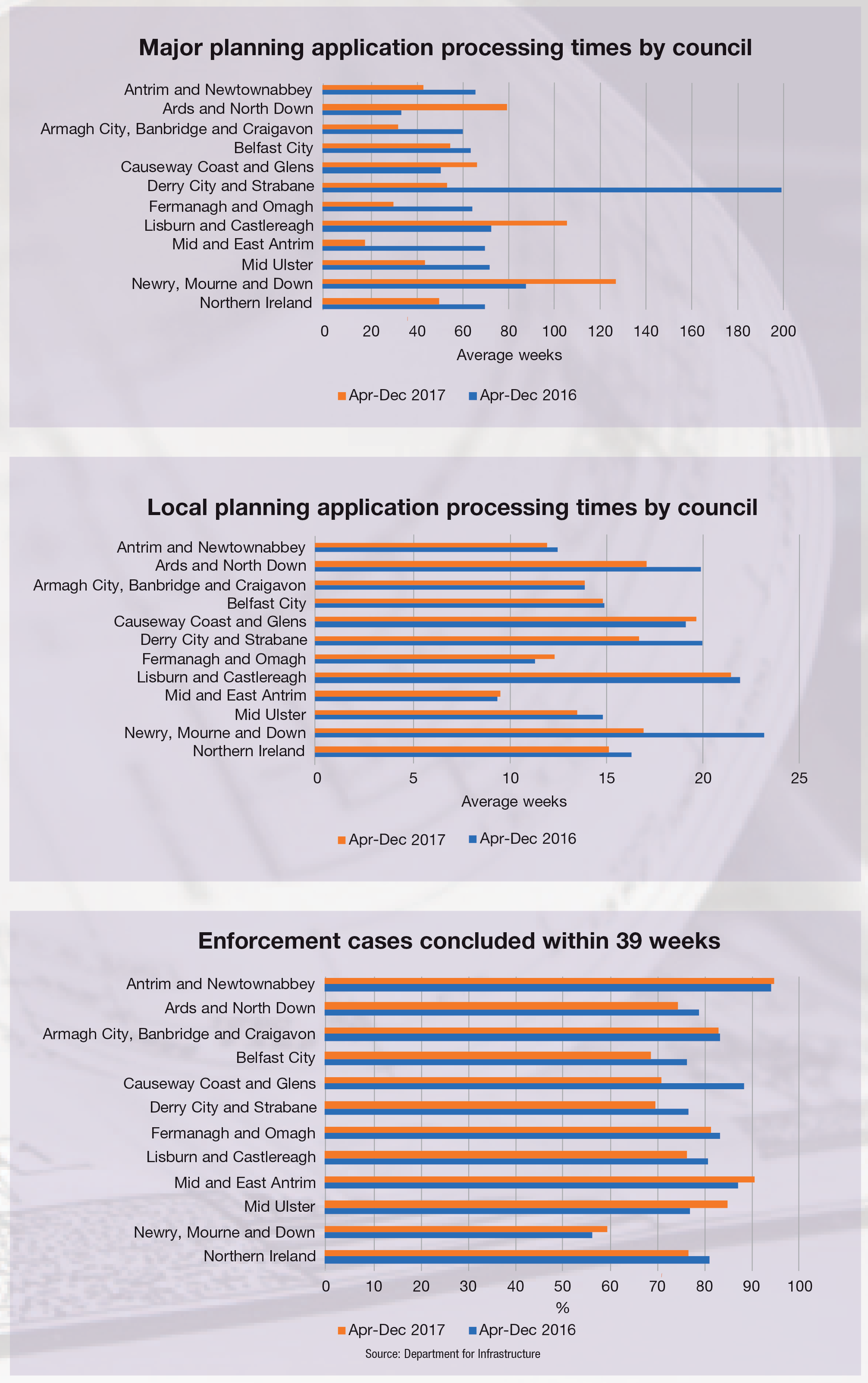

The average processing time for major planning applications across all 11 councils in the first nine months of 2017/18 was 50.4 weeks. This is 20 weeks longer than the 30-week statutory processing time target.

The average processing time for local planning applications across all 11 councils in the same period was 15.2 weeks. This slightly exceeds the 15-week target, which was met by six of the 11 councils.

In the first nine months of 2017/18, 77 per cent of enforcement cases were concluded within 39 weeks, 7 per cent above the statutory target