Europe and Brexit

Brexit: Key risks for Northern Ireland

A Freedom of Information request by The Detail.tv has revealed that officials from the then Office of First Minister and deputy First Minister (OFMDFM) complied a report on the risks posed to Northern Ireland in the event of a Brexit in May 2015, which was not published prior to the referendum campaign. While a political storm has developed as to why the report was blocked from being published, agendaNi has turned its focus to what exactly civil servants identified as the 21 key risks for Northern Ireland within the ‘Preliminary analysis on the impact of a UK referendum on its membership of the European Union’ report.

21 risks facing Northern Ireland post Brexit

- Uncertainty The exact terms of the withdrawal will dictate the rules governing access to EU Markets.

- Contribution While the UK is deemed a net contributor to the EU, Northern Ireland is a net beneficiary and any immediate financial impact is likely to be negative.

- Funding loss Depending on the terms of withdrawal, Northern Ireland stands to lose €862 million in Structural Funds, €2.5 billion in Common Agricultural Policy funding (both 2014-20) and suffer loss of access to competitive EU funding, which from 2011/12 to 2013/14 has amounted to £72.7 million.

- Economic development Across 2007-2013 EU support accounted for approximately 8.4 per cent of annual GDP, two thirds of which was based in agriculture. Lack of subsidies would put Northern Ireland farmers and related industries at a disadvantage to their Republic of Ireland (RoI) counterparts.

- GDP drop An estimated drop of 3 per cent GDP.

- FDI Northern Ireland “might” become a less attractive region for Foreign Direct Investment (FDI), especially for companies wishing to do business within the EU.

- Corporation tax In the likely event that the Republic of Ireland becomes a more favourable investment option for developing economies, plans to harmonise corporation tax rates could be undermined with budgetary and transactions costs rising significantly.

- Development Any fall in FDI will impact on demand for domestic production, further impacting on training requirements, a decline in skills levels and demand for tradeable and non-tradeable services.

- Connectivity Transatlantic air traffic regulations are negotiated at EU level meaning leaving could be “detrimental” to Northern Ireland’s connectivity.

- Access Loss of access to the benefits of EU Trade Agreements.

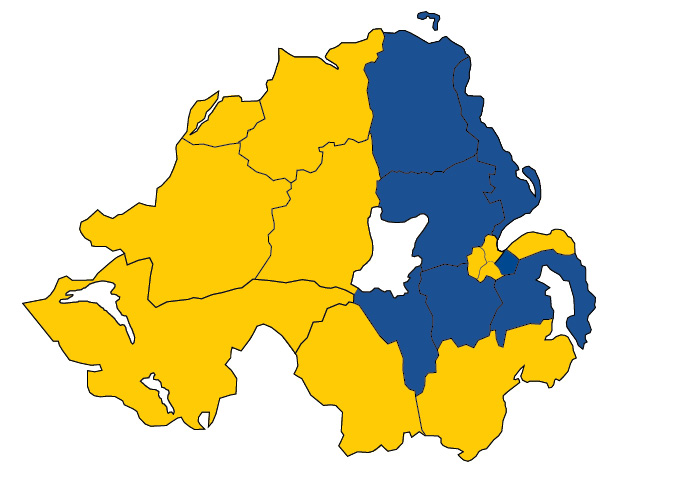

- Location Northern Ireland is in the unique position of being the only part of the UK to have a land border with another EU Member State and the Eurozone.

- Border cost As well as the flow of people, capital, animals and goods and services, a full external EU land border with RoI is also likely to come with “significant” administrative costs, especially as RoI is Northern Ireland’s second largest trading partner.

- Passport control A customs border including passport control will result in direct costs for Northern Ireland and indirect costs for trade.

- Trade The cost of cross border trade and economic co-operation would increase including the cost of infrastructure projects.

- Legal resources A significant workload will develop from restructuring the Northern Ireland statue book and practical legal arrangements. Any UK treaty and agreement negotiated will require devolved primary and secondary legislation.

- Health Cross border co-operation could become more complicated for the health service.

- Employment law As a devolved matter, any differences in Northern Ireland and Great Britain employment law could create competitive differences for different regions and therefore attractiveness to workers.

- Standards Employment standards differences with RoI could impact on the Northern Ireland economy regarding FDI projects.

- Agriculture Northern Ireland could be expected to be treated as a third country under international trade rules developed by the World Trade Organisation for Animal Health. These extensive rules including import/export of livestock to EU member states (including RoI) will result in added costs.

- EEA If the UK opts for the Norway model and remains in the EEA then the impact of strict animal health rules could be mitigated.

- All-island Any withdrawal would impact on all-island work including plant and animal health and welfare and co-operation under EU programmes, including the Rural Development Programme.