Budget: Public spending outlook bleak

Despite headline figures of Covid support emerging from the UK budget, the long-term outlook for public spending in Northern Ireland remains bleak, writes David Whelan.

While the £412 million extra for Northern Ireland as part of the Chancellor of the Exchequer Rishi Sunak’s March budget was welcomed in Northern Ireland, the Covid-related nature of the money will have little impact on the Executive’s day-to-day spending capability.

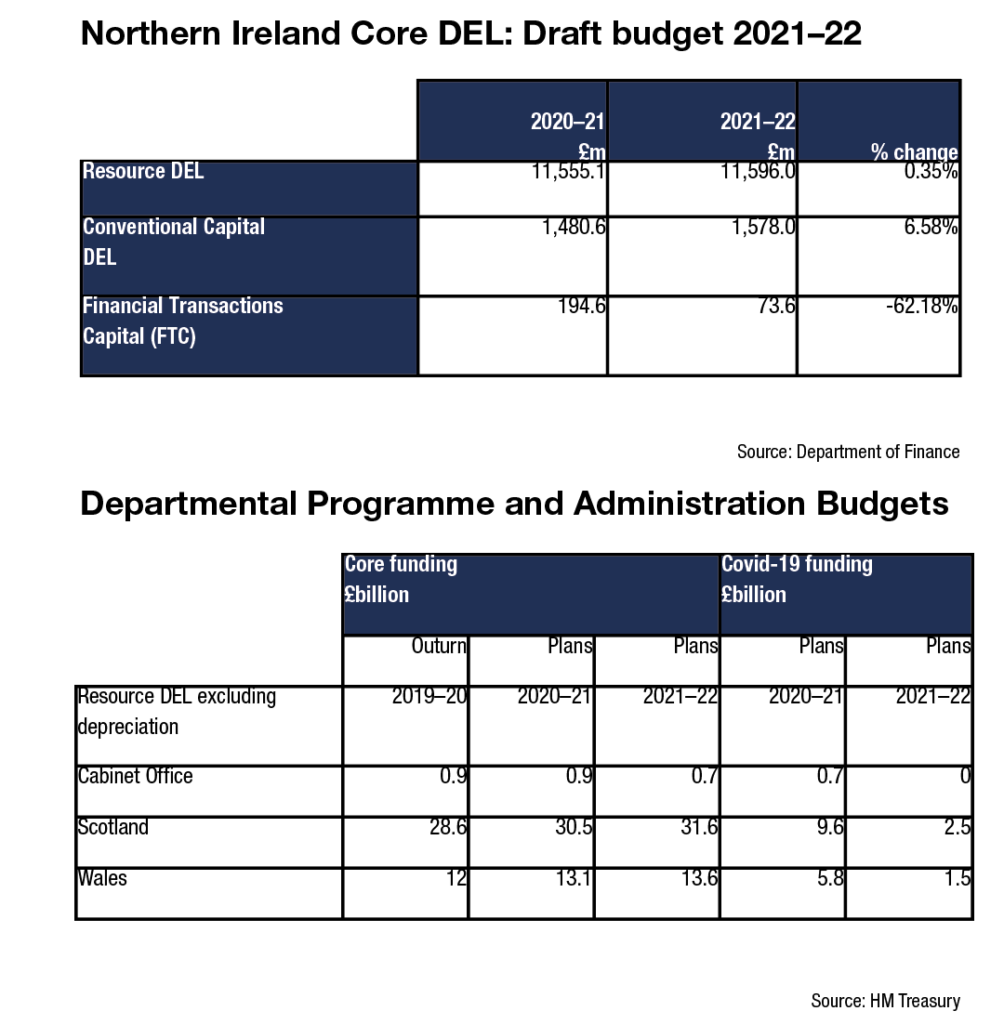

Northern Ireland’s Finance Minister described a ‘flat-cash budget’ for mainstream public services after it was revealed that core spending for Stormont departments will rise by only £4.2 million, with no additional capital funding, as a result of the UK budget.

Murphy had lobbied for extra capital money to act as a stimulus to the Northern Ireland economy as it seeks to recover from the impact of Covid-19 but none was forthcoming.

“An investment-led approach is absolutely critical given we have never fully emerged from years of austerity measures,” he had argued.

UK Chancellor Rishi Sunak says that he delivered a budget that “meets the moment” but his further claims that investment will fuel economic growth and “ensure we bounce back from this pandemic together” has been met with scepticism.

The budget also confirmed the now well-known move by the UK Government not to apply the Barnett formula to replacement EU funding and enable the devolved nations to administer funds. Instead, the Government will retain control of the Levelling Up Fund in Westminster.

The budget did provide some financial relief, particularly for businesses and the worst-hit public services in the form of furlough extension, additional supports for the newly self-employed and Covid-related funding.

The furlough extension will serve as a relief for many businesses in Northern Ireland. With heavy restrictions still in place, over 100,000 people remain on the scheme and there were fears that the proposed end date for the scheme would have proved a cliff-edge scenario for employers.

However, concerns have been raised that changes to the scheme which will require employers to pay 10 per cent towards employee hours not worked in July and increasing to 20 per cent in August and September.

Many have read changes to the scheme as a government assumption that the economy, particularly the private sector, will be fully operational again by June. However, with the Northern Ireland Executive and the UK Government operating different restriction lifting roadmaps and with expected differing levels of economic recovery, the threat of higher levels of redundancies in Northern Ireland in coming months is evident.

The Chancellor also announced that the Northern Ireland Housing Executive (NIHE) is to be exempted from Corporation Tax from 2021–22, an estimated £10 million annual saving to the Northern Ireland Executive.

Concern about the long-term outlook for public spending in Northern Ireland had already been raised after Finance Minister Conor Murphy brought the draft budget for 2021–2022 to the Northern Ireland Assembly in January 2020.

The budget outlined a decline in day-to-day expenditure in cash terms and once adjusted for inflation represents a cut to current expenditure on public services. It is important to recognise that figures for this budget are not being compared against a Covid-inflated budget last year. The nature of the 2020-21 budget was such that it only included £120 million for Covid response as its publication coincided with the beginning of the pandemic. Northern Ireland received more than £3 billion in Covid-funding in total but this was managed on an ad-hoc basis.

“I recognise for most departments the draft budget outcome represents flat cash settlement which will mean effective reductions once increased costs and demands on services are taken into account. Choices will have to be made, public services will have to be prioritised,” said Murphy.

The Finance Minister described the budget as “difficult” and set out a “standstill” position from the previous 2020–2021 budget.

In terms of Covid response, the Department of Finance allocated £380 million of the £538 million Covid response funding to the Department of Health, £30.6 million to the Department of Education, £700,000 towards higher education and £126.9 million remains to be allocated.

The Minister opted not to increase revenue through the increase of regional rates. However, following the UK budget announcement, Murphy has announced his intention to follow through on a New Decade, New Approach agreement to establish a fiscal commission to examine the Executive’s tax-varying powers.

One of the main examinations by the commission will likely be the corporation tax rate. Northern Ireland secured powers to devolve the corporation tax rate through the Fresh Start Agreement in 2015. At the time, the Executive pledged to lower the rate in line with the Republic of Ireland to 12.5 per cent but has never diverged from the UK rate. With the UK planning to raise its rate to 25 per cent in 2023, Northern Ireland may now seek to gain a competitive advantage.