Research — Examine. Inform. Enable.

As the strategic housing authority in Northern Ireland, the Housing Executive has a statutory responsibility to regularly examine housing conditions and need, and may also conduct or promote research into any matter relating to any of its functions. The research programme looks at a range of issues including and beyond those relating to its landlord function, and seeks to inform data and evidence needs across all tenures, including the private rented sector.

The Housing Executive’s Research Unit carries out and commissions strategic, customer and technical research projects every year. Our research assists in the evaluation of policies and strategies and feeds into broader collaboration with other research and housing organisations across the UK.

Quality data and research provides a critical insight into important housing matters, and there is a clear need for future decisions to be evidence based as budgetary resources continue to diminish.

Our research programme is created in consultation with key internal and external stakeholders. Our surveys and analysis are conducted in-house alongside commissioned work undertaken by independent experts and social/market research companies.

Some of our ongoing projects include the Northern Ireland House Condition Survey, the Quarterly House Price Index (in collaboration with Ulster University and Progressive Building Society) and the Continuous Tenant Omnibus Survey (CTOS).

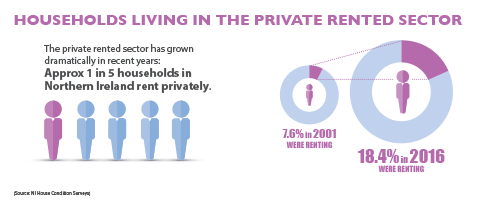

In March at our bi-annual Insight Exchange, we launched the results of our Private Tenants Survey. We carried out the survey following the 2016 House Condition Survey (HCS). That survey revealed that approximately one in five households in Northern Ireland are privately rented. Traditionally a difficult sector of the housing market to access, the findings of the Private Tenants Survey are an important addition to the existing body of research into private renting.

The private rented sector, which has grown dramatically in size and importance in recent decades, is inextricably linked to the wider social, economic and political context and to what is happening in other sectors of the housing market. Social housing waiting lists and difficulty accessing the owner occupied sector are among the key factors driving the demand for private rented housing.

The survey provides an important insight into the views and experiences of private tenants. It covers a comprehensive range of topics including affordability, the landlord-tenant relationship, future intentions and regulation within the sector, which build on previous surveys carried out in 2006 and 2012.

The survey found:

- 83% of respondents were satisfied with their current accommodation and 86% said they were on good terms with their landlord/letting agent;

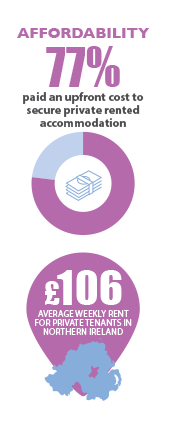

- Three quarters of tenants (77%) had paid an up-front cost, in the form of a deposit and/or rent in advance, to secure their accommodation;

- The average amount paid up-front was £794 and almost half (47%) said they had found these costs difficult to afford;

- 59% received Housing Benefit to cover their housing costs;

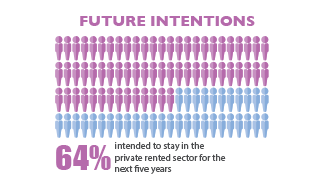

- 64% of private tenants intended to stay in the sector for the next five years.

The survey indicated that private renting provides an accessible housing option for a wide range of households, especially when other alternatives are not available. The most common reasons for renting privately related to family/personal circumstances (29%) and difficulty accessing social or owner-occupied housing (22%), and only one quarter in total of those surveyed intended to move to a Housing Executive dwelling, or to buy their own home, within the next five years.

The survey also suggests that landlords are becoming more professional in their approach to tenancy management. By 2016, the proportion of respondents who had a written tenancy agreement had increased to 77%, compared with 68% in 2012. However, landlords are also obliged to provide tenants with rent books and energy performance certificates for their dwellings. A much lower proportion of respondents had received these documents, suggesting there is still some way to go to ensure that both tenants and landlords are aware of, and comply with, their legal rights and responsibilities.

The Insight Exchange provides an opportunity to engage with key stakeholders and decision makers, to sense check recent findings emerging from research studies undertaken and to ensure that our Research Unit continues to meet the needs of the sector.

The Insight Exchange focused on the private rented sector, allowing senior staff from across the sector to engage in debate and discussion, and to express their views about critical emerging issues facing the sector in Northern Ireland.

At this month’s event, Dr Martin Hinch and Dr John McCord from Ulster University discussed in detail the performance of the private rental market in Northern Ireland, which was followed by short talks on policy issues, viewpoints and regulatory approaches from local housing professionals in the Department for Communities and the Chartered Institute of Housing. Kath Scanlon, from the London School of Economics, spoke at length about the national and international evidence and approaches on private renting.

Find more details on our research here: https://www.nihe.gov.uk/private_tenants_survey_2016.pdf

Housing Center, 2 Adelaide Street, Belfast BT2 8PB

Housing Center, 2 Adelaide Street, Belfast BT2 8PB

Tel: 03448 920 900

www.nihe.gov.uk