Stronger than expected manufacturing performance

Despite the wider downturn of global manufacturing and a similar downturn in overall UK production, Northern Ireland’s index of production has risen for the sixth time in the last seven quarters. Figures released by the Department for the Economy for 2019’s second quarter show a continued the recovery of the production index since its most recent nadir of Q3 2017, however given Brexit’s potential market influence, there are concerns for the future of Northern Ireland’s largest employment growth sector.

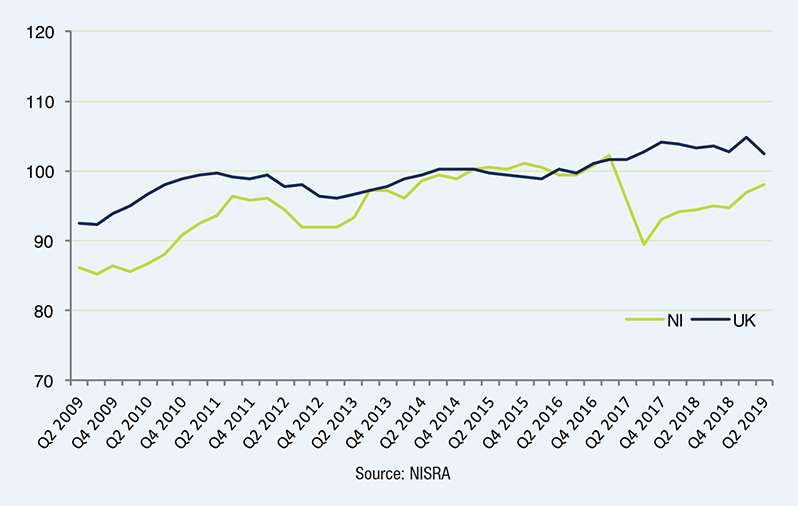

The index of production, which provides information on the output of the production and manufacturing sectors and market trends, peaked in Northern Ireland during the post-Brexit vote stockpiling rush, with the index hitting its peak in Q1 of 2017. While the overall UK index of production continued to rise after Q1 2017, Northern Ireland’s index (which had been ahead of the UK overall in both Q4 2016 and Q1 2017) had plummeted by 10.5 per cent by Q3 2017.

While stockpiling has provided a boost to Northern production, a downturn such as the one seen in the UK is expected soon. Brexit uncertainty also casts serious doubts over the future of company investment and well as the future location of those companies.

Northern Ireland’s index of production for Q2 2019 enjoyed a quarterly increase of 1.2 per cent and yearly increase of 3.6 per cent from Q2 2018. While still lower than the UK overall, the gap has now been closed to 1.9 per cent, a significant improvement on both the peak levels of the gap (10.4 per cent in Q3 2017) and the gap during Q2 2018, 5.8 per cent.

The UK’s index of production has fluctuated of late, following an up-down trend every quarter since Q1 of 2018. It has decreased in Q2 2019 by 1.4 per cent quarterly and 0.5 per cent yearly but is still at a higher point that it was in any quarter between Q2 2009 and Q2 2017.

The quarterly increase in Northern Ireland’s production was driven by increases in all four main sectors: Manufacturing saw an increase of 1 per cent; water supply, sewerage and waste management (including recycling) rose by 2.7 per cent; electricity, gas, steam and air conditioning supply increased by 0.8 per cent; and mining and quarrying rose by 7.7 per cent.

Similarly, the yearly increase of 3.6 per cent was driven by an identical increase in manufacturing, a 4.4 per cent increase in water supply, sewerage and waste management (including recycling) and an 11.7 per cent increase in mining and quarrying. The yearly increase was, however, slightly offset by a decrease in the index of production for electricity, gas, steam and air conditioning supply, which fell by 1.5 per cent on the year.

Manufacturing

The sustained rise in Northern Ireland’s index of production has been buoyed by sustained increases in the manufacturing sector. Manufacturing as a whole saw a 3.7 per cent increase on a rolling four quarters basis to go along with its 1 per cent quarterly and 3.6 per cent yearly increases. This has continued the trend of steadily increasing manufacturing output and overall outlook for manufacturing in Northern Ireland. The skills barometer recently published by the Department for the Economy predicted that the sector would add 5,480 jobs by 2028 in its “most likely” growth scenario and a possible 10,430 jobs in a high growth scenario.

However, the recent dangers to big firms such as Wrightbus, Harland and Wolff and the closure of Belfast’s Gallaher Tobacco factory in 2014, along with a recent Ulster Bank report that stated that Northern Ireland is experiencing its fastest rate of job losses in over seven years, make it difficult to see where this job growth will come from.

Despite the rises, Northern Ireland’s manufacturing is still 4.2 per below its highest point of production recorded in Q1 2017, although it is 14.9 per cent above its low point, recorded in Q3 2019. These increases have been driven within manufacturing by three of the six major subsectors experiencing increases, with textiles, wearing apparel and leather products reach a 10-year high.

The quarterly increase was driven by three increases: textiles, wearing apparel and leather products manufacturing rose by 4 per cent; food products, beverages and tobacco products increased by 1.9 per cent; and engineering and allied industries rose by 1.7 per cent. However, these gains were somewhat offset by decreases in the other three main subsectors: basic metals and fabricated metal products fell by 5.1 per cent; chemical and pharmaceutical products decreased by 4.9 per cent; and total other manufacturing fell by 2 per cent.

However, only one of the subsectors suffered a yearly decrease, total other manufacturing falling year-round by 7.3 per cent. All other subsectors enjoyed year-round increases: textiles, wearing apparel and leather products manufacturing rose by a massive 35.3 per cent; basic metals and fabricated metal products by 7.7 per cent; chemical and pharmaceutical products by 7.6 per cent; engineering and allied industries by 4.2 per cent; and food products, beverages and tobacco by 0.9 per cent.

Northern Ireland’s manufacturing of textiles, wearing apparel and leather products has risen to a 10-year high and has experienced quarterly growth in nine of the last 11 quarters. The output in this subsector is now 57.1 per cent above the low point recorded by the index of production in Q3 2019. Conversely, the fall of production levels in the manufacture of basic metals and fabricated metal products has seen it fall 5.1 per cent off its peak, achieved in Q1 2019. However, this level is still an astounding 128.3 per cent above the index’s low in Q3 2010.

The manufacture of chemical and pharmaceutical products also reached its index peak in Q1 2019 and its quarterly decrease sees it lying 4.9 per cent below its peak, but 8.4 per cent above its 10-year low. Despite the encouraging long-term figures, worries could arise due to the turbulent nature of recent production, with five of the last 12 quarters seeing decreases. Total other manufacturing, the only subsector to suffer a year-round decrease, now lies 7.8 per cent below its peak and 19.5 per cent above its low point.

The subsector closest to its nadir remains food, beverages and tobacco products manufacturing, which continued its recovery from its Q4 2017 low point, but still lies just 8.3 per cent above it while being 46.6 per cent shy of its Q2 2019 peak. Nearing its peak is engineering and allied industries, just 1.5 per cent shy of the high point recorded in Q4 2018. The subsector also lies 63.8 per cent above it’s the 10-year low it recorded in Q3 of 2009.