Uncertainty in the housing market

A slowdown in Northern Ireland’s housing market has been attributed to higher levels of uncertainty in economic stability, caused, not least, by major challenges such as Brexit.

The latest Northern Ireland Quarterly House Price Index for the final quarter of 2016 has presented a slowing of the residential property market in both average house price and level of market transactions. The current average house price of £150,778 represents a reduction not just over the final quarter of the year (-£9,154) but also a 2.5 per cent fall from the average price during the same period last year. However, despite the fall in Q4, the overall average house price for the whole of 2016 (£154,028) was higher than the in 2015 (£149,449), “continuing the trend of more gradual and sustainable house price growth since lowest prices in 2013”.

Offering a potential explanation for the downturn, the Price Index states that the indicators point towards “a more hesitant market potentially influenced by the enhanced macro-economic uncertainty”. As well as Brexit, it highlights the current political situation in Northern Ireland as unhelpful in stabilising the local market.

The downturn has been severe enough to affect all price bands, the amount of properties sold under £100,000 increased in the final quarter of 2016 to make up 30 per cent of transactions and properties sold at or below £200,000 is now 65 per cent of all sales compared to 61 per cent the previous quarter.

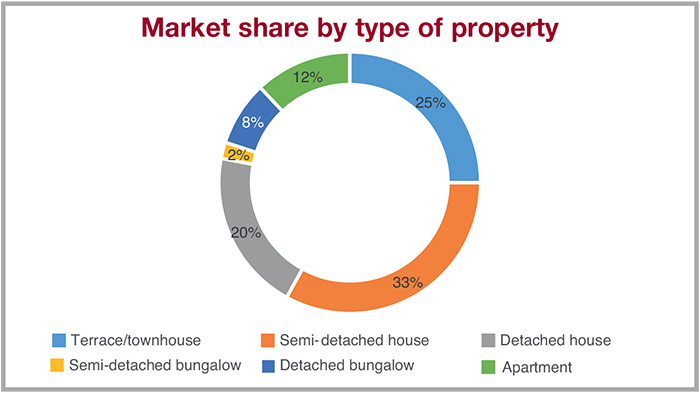

Property type

In terms of specific property price performance in the context of an annual average house price decline, terraced/townhouses are down by 2 per cent (£100,541). Semi-detached properties have experienced the largest drop in average price by 4 per cent (£140,324), while the average detached house price fell by 1.1 per cent (£239,118). The average price of detached bungalows remains largely unchanged (£179,572) but the average price of semi-detached bungalows has risen significantly by 12.8 per cent to (£113,620). As has the prices of apartments (£123,312), which are up by 4.8 per cent.

Regions

House prices in Northern Ireland remain variable across local regions. Six regions, predominantly those further from Belfast and who had seen the least price appreciation in the first three quarters of 2016, witnessed increasing prices. Prices in the east of Northern Ireland, areas such as Belfast, Lisburn, North Down and Mid/South Down, fell over the year. The report states that while unclear, the fall in prices in areas usually consistent with reflecting the overall market performance, could indicate a more widespread slowing of house price growth.

Michael Boyd, deputy Chief Executive and Finance Director of Progressive Building Society summarises: “The next few months may test the resolve of the local housing market as we will see whether continuing low borrowing costs and lack of housing supply coming onto the market outweigh the uncertainties over Brexit and local political concerns.

“However, the economic fundamentals remain strong. The last quarter of the year is traditionally a slower time for domestic property sales but transaction numbers remained at encouraging levels. The market remains finely balanced, with a leaning towards the upside.”