The referendum fallout

Ulster University Economic Policy Centre’s Neil Gibson analyses the possible scenarios and alternate futures for the Northern Ireland economy in an era of uncertainty.

Ulster University Economic Policy Centre’s Neil Gibson analyses the possible scenarios and alternate futures for the Northern Ireland economy in an era of uncertainty.

Forecasting is challenging at the best of times, it is impossible to foresee shocks that materially impact economic conditions and it relies on partial or delayed information. Post Brexit the lack of information has made forecasting even less evidence based with total uncertainty over UK trading conditions, migration policy and even government spending plans. UUEPC will not be producing a full set of forecasts until later in the year when perhaps a little more clarity will exist surrounding the policy direction. It is more sensible at this point to look at possible scenarios, alternate futures that might come to pass depending on how the various negotiations play out during the slow EU divorce.

Prior to the vote there was a lot of economic analysis and a large number of forecasts produced, most (though not all) suggested the effect would be negative. Many of these forecasts relied on misleading assumptions, including assuming that trade would deteriorate with the EU but no offsetting trade would be established elsewhere. This seems highly unlikely and it is unforgiveable that this formed the basis of the Treasury’s own ‘independent assessment’. The understandable nervousness about the unknown makes the predictions of economic catastrophe understandable but it does not make them reliable predictors of the future.

The UK has suffered a currency depreciation, and may indulge in further expansionary monetary policy and even reflationary fiscal policy to boost demand. Ending austerity and a devalued currency are desirable outcomes for the UK economy so it is not obvious that the economic fallout will be the disaster many economists have placed their reputations on. That is not to underscore the very obvious risks but care needs to be taken to unpick conjecture from evidence.

Before leaving the topic of the EU it is important to set just a little context for the debate going forward. The EU has many economic problems, as indeed does the UK (notably an unhealthy consumer dependence). Looking at unemployment rates across Europe do not provide a particularly ringing endorsement of EU’s economic benefits. Equally looking back to the 1950’s the UK’s growth rate, particularly when set out per head (which is analogous to standards of living) does not make the economic benefits of EU membership glaringly obvious.

It is easy to say that migration was the critical policy issue for those voting to leave, even though half the UK in-migration is non-EU, but perhaps it was also the economics – not everyone believed the economics of ‘in’? If real GDP per head has grown at an average rate of 1.4 per cent over the last five years, there is reason to suggest that the headline growth figures are the wrong place for a politician look to find endorsement of their economic policy.

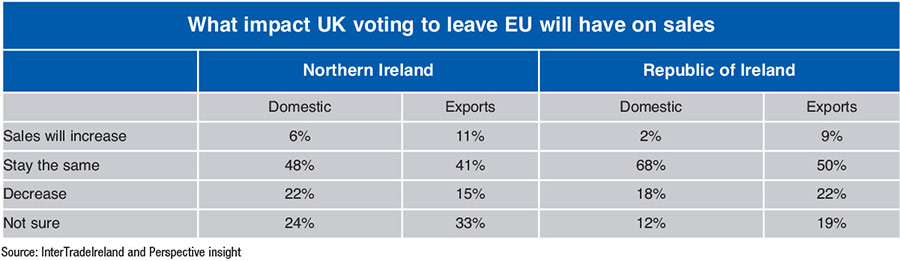

The Intertrade Ireland survey, which provides a quarterly barometer on business issues across the island provides some early feedback on the initial reaction to Brexit. The results suggest a concern across firms either side of the border, though perhaps not as severe as might have been expected. Less than a quarter are expecting a fall in sales.

In Northern Ireland more firms are not sure what will happen to sales than expect a fall. Flash polls by the CBI have raised greater concern and the Purchasing Managers Index suggest a fairly sharp downturn is likely. Each of these, whilst useful, will be much more meaningful when they cover a longer period, perhaps a full quarter, to determine how firms have responded after the initial shock. The IntertradeIreland survey reveals less than 5 per cent of firms in Northern Ireland or ROI have a plan for dealing with the Brexit fallout suggesting it will take some time before their behavioural response is clear.

Northern Ireland – finally getting back to the start line

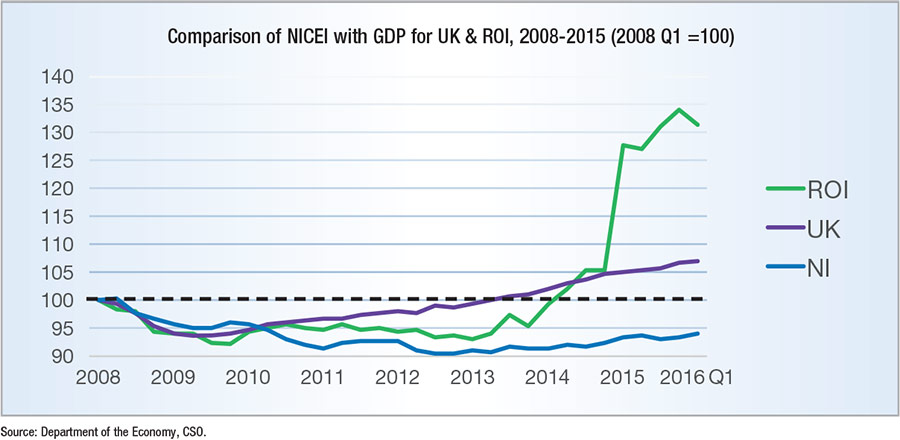

With the advent of a new Programme for Government and a new Executive with a less complex two-party system this arguably was the start line of a new phase for the Northern Ireland economy. One in which greater local responsibility would be taken for economic outcomes and one in which local policy choices would be enacted, starting with the lowering of corporation tax. The economy suffered badly in the recession and even in 2016 the labour market has not fully recovered. Workforce jobs are still lower than they were in 2008, though this is not the case if construction is excluded. Compared to neighbours in Ireland and the UK, Northern Ireland’s output performance (as proxied by the composite index) has been extremely weak and the labour market, though stronger than the Irish performance, has also lagged its UK comparator. The truly bizarre Irish GDP data further demonstrates how unhelpful the indicator is as a measure of the health of an economy. The reasons for the scarcely believable pattern are complex and not entirely clear though huge increases in capital stock, tax inversion and contract manufacturing are all factors. It appears the reason is linked to a very small number of firms, again showing how distorted the measure is as an overall health indicator.

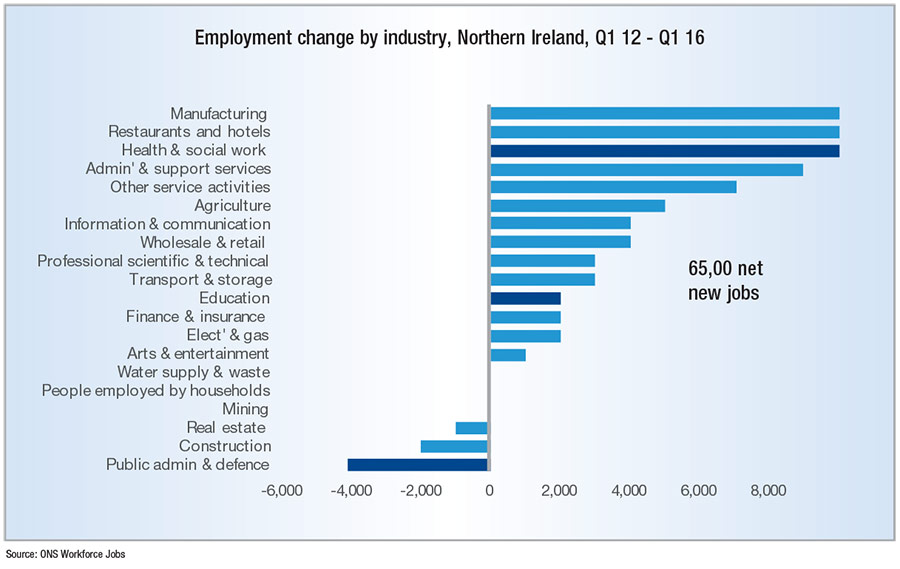

The sectoral job performance is particularly interesting with manufacturing showing a very strong performance alongside health and restaurants / hotels. This is despite austerity, a squeeze on incomes from low wage growth and the pressure on manufacturing from international competition. The major job losses in the industrial sector that have been announced over the last 12 months are yet to hit the official data series but it is encouraging that the sector has shown resilience in the recent past. The sectoral mix continues to be extremely eclectic which is welcome as it provides job opportunities across the skills spectrum and across the 11 local council areas. This ‘variety of success’ does make lending or investment decisions rather more challenging as the sector a business is in will not provide sufficient intelligence as to whether the business will be successful or not.

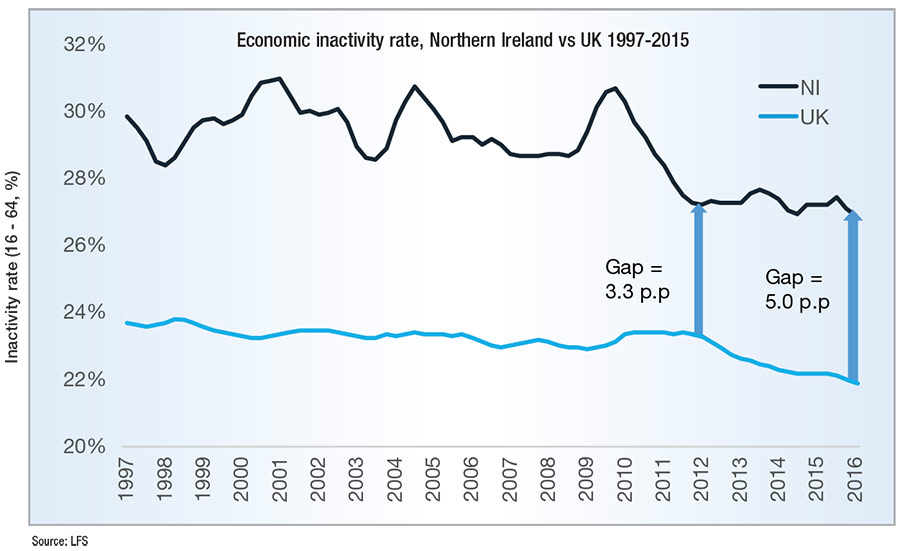

When looking at the labour market data and the unemployment register it is easy to draw the conclusion that, setting Brexit aside for a moment, the economy was on track and ‘steady as she goes’ would be a wise policy mantra. This conclusion would be incorrect. The NI labour market remains hamstrung by structural weaknesses that have existed for decades, and in some cases are getting worse. The patterns observed in NI productivity and inactivity are perhaps the two most significant, and stubborn, challenges.

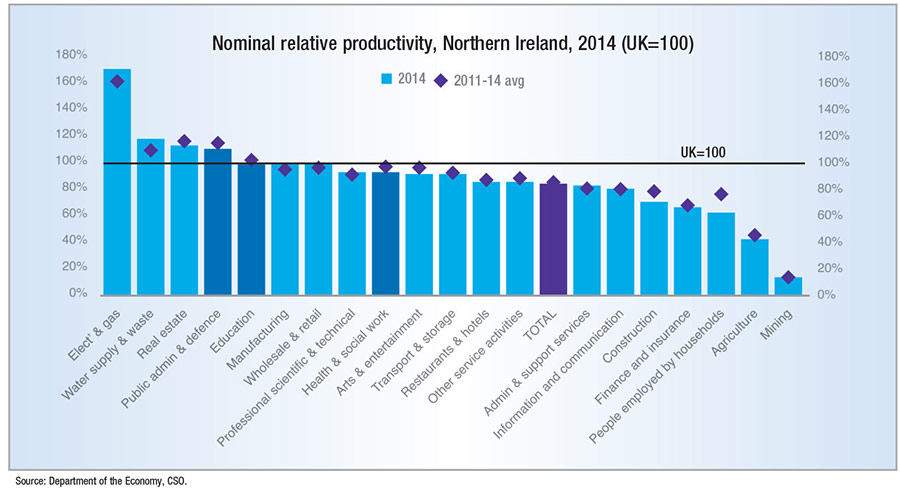

Productivity lagging and apparently within sectors

The weakness of Northern Ireland productivity has long been quoted and has been the focus of many an economic policy document. It shows no sign of improving with the latest data still recording a 15 per cent deficit with the UK as a whole and 5 per cent with the UK excluding London and the South East. The reasons for this weakness are complex and beyond the scope of this article to consider fully. The CBI are undertaking work on this area and the Economic Advisory Group have also carried out some preliminary analysis. In summary the problem is both one of ‘what’ Northern Ireland does (it has more activity in lower value added sectors) and ‘how’ it does it with many sectors exhibiting below average productivity levels. There is much to do to understand the patterns in sectoral productivity, assuming the underlying data is not misleading in the way that the Irish GDP numbers clearly are.

The second of the twin challenges is persistent levels of high inactivity. The furore over possible welfare reform has distracted from the importance of the question – what is the modern welfare state that we want to have in Northern Ireland? It would seem obvious to suggest it would be one that is fair and supportive, one that works hard to help people where appropriate back into or towards the labour market but also one that is affordable. The current system looks increasingly problematic on the last of these criteria.

Current forecasts for the Northern Ireland Executive 2016/17 budget expenditure suggest that the welfare state (benefits only) costs circa £5.9 billion per annum, more than the total income tax take and VAT take in NI, circa £5.8 billion. This is not sustainable longer term, though as it is paid for by Westminster it is not immediately obvious that the lack of affordability features heavily in the local debate surrounding the system. On the face of it the headline news is good with inactivity levels falling, however this is largely attributable to a fall in the number of students. A worrying rise in sickness levels is evident in the data and not replicated across the UK. The reasons for this are complex and additional research needs to be understand the ‘who’ and ‘why’ of this trend. It is clearly out of line with elsewhere in the UK and even allowing for the oft quoted ‘special circumstances’ in Northern Ireland it is hard to see that they justify the very recent divergence. The Conservative plans for welfare reform were hugely unpopular locally. If the local Executive were to be given greater control of welfare, including greater responsibility for paying for it, perhaps more innovative and effective methods of reform might be implemented. This debate should never be misunderstood as an attack on the welfare state nor a questioning of the large number of people unable to work in society but rather a more strategic question that must be answered – what does a modern, fair, affordable, understanding and ultimately successful welfare state look like?

As discussed at the beginning of this article, assessing potential outlooks for Northern Ireland is very challenging given the Brexit uncertainty. The Cambridge Business School / UUEPC forecasts which form the basis for the UUEPC Northern Ireland forecasting are currently suggesting a weaker outlook in 2017 but that was also the case pre vote. Although the majority of attention has focussed on a reduction in corporate investment levels, it is the consumer behaviour in the short run that will matter most for UK and consequently Northern Ireland, economic performance. A slowdown in consumer spending would certainly bring the potential for recession in a way that a slowdown in corporate investment alone would not do. With the possibility of an end (or at least a slowdown) in austerity policy and moves to encourage consumers to spend (such as reduced interest rates) the impact could be relatively muted on spending.

There is no rational reason for spending to fall in the short term but fear is a powerful influencer of behaviour. Voters may have ignored many of the ‘experts’ in voting to leave but will they continue to do so and carry on spending? House and share prices are key influencers of spending behaviour. Even if consumers are not selling a house or do not own shares the indicators are important and thus early data will be scrutinized carefully. Share price data, which in the short term is largely meaningless from an economic intelligence point of view, has been very volatile but has not slumped in the way many forecasters of doom had projected, in fact spotting the Brexit vote on a long term chart is rather hard to do.

House price data will be slower to arrive and the first few months of data will be largely immaterial though they could have an important bearing on people’s perception of the likely impact. One of the hardest things in assessing the impact will be to ignore the immediate ‘month after’ data and analyse a longer run when it arrives, this will of course be difficult to do. The first Purchasing Managers Index data was extensively covered in the press, pointing as it did to a marked slow-down. Waiting until later in the year to produce forecasts seems prudent, though many organisations have begun to put out their predictions already.

Interestingly no forecast of a recession exists, which is surprising given what was said before the vote, though a marked slow-down is predicted. Even the IMF who suggested a recession was a ‘probability’ before the vote have not seen fit to make their base forecast post Brexit match this ‘probability’. It is likely a slow-down in corporate investment will occur, but the consumer reaction is critical in the short run. The up-sides of a lower currency and possibly of some government stimulus cannot be discounted and longer term predictions need to be considered both in GDP levels terms and on a per head basis. After all the vote has told us that the public may no longer be sending a message ‘it is the economy stupid’ but rather ‘it is my personal wealth stupid’ that seems (somewhat sadly I may add) to matter most in the UK today.

UUEPC will produce post Brexit forecasts in Autumn 2016.

Analysis provided by Jordan Buchanan.